Why We Believe Financial Planning Matters

Retirement should be a time of freedom—not fear. Yet for many recently retired professionals, this new chapter can bring a flood of overwhelming questions:

- “Did we save enough?”

- “Will market volatility derail our plans?”

- “What happens if one of us needs care—or passes away?”

At Kelley Pyles’ office, we understand that financial planning is about more than just numbers on a page. It’s about creating clarity, confidence, and peace of mind during one of life’s biggest transitions.

There is no one-size-fits-all formula.

We believe in bridging the gap between two traditionally competing worlds—insurance and managed money—to provide a well-rounded, customized strategy. Every client’s ideal plan involves a unique balance between safety and risk, designed around their individual needs, goals, and comfort level.

We educate our clients that this balance isn’t dictated by age—it’s defined by what you want your money to do for you.

Whether you’re focused on preserving wealth, generating reliable income, planning for long-term care, or leaving a legacy, we’re here to help simplify the complexity and build a plan that supports your future with confidence.

Relocating to Central Florida often means leaving behind trusted advisors. We’re here to reestablish that trust—locally. Our approach is built on education, empathy, and long-term partnership—not transactions.

What is a Fiduciary?

A fiduciary is a financial advisor who is legally and ethically obligated to put your best interests first—always. That means any recommendations we make are based solely on what’s right for you, not what benefits us.

As a fiduciary, we provide transparent, conflict-free advice to help you make confident decisions about your retirement, investments, and legacy.

Reducing Future Tax Burdens & Maximizing Benefits

Tax laws change—but your plan shouldn’t suffer because of it. We build forward-looking tax strategies to help minimize Required Minimum Distributions (RMDs), reduce IRMAA penalties, and preserve your legacy for the next generation. Our goal is to turn potential tax burdens into long-term benefits.

Tax-Efficient Income Strategy Planning

Generating retirement income isn’t just about how much you withdraw—it’s about how you withdraw it. We help you design a tax-smart income strategy that coordinates Social Security, pensions, and investment withdrawals to keep more money in your pocket and avoid unnecessary tax surprises.

Managing Risk with Balance

Market ups and downs shouldn’t dictate your peace of mind. We help you find the right balance between risk and safety—not based on your age, but on your goals, income needs, and comfort level. Through a personalized approach blending managed money and protective strategies, your plan stays aligned with your future.

Managing Capital Gains

Selling appreciated assets without a plan can lead to unexpected tax bills. We help you strategically manage capital gains by timing withdrawals, using tax-loss harvesting when appropriate, and aligning your investment strategy with your long-term tax goals.

Planning for Life's Pitfalls

Retirement isn’t without its challenges—long-term care needs, the loss of a spouse, or sudden medical costs can all derail even the best-laid plans. We prepare you with proactive strategies to protect your income, care for your loved ones, and weather unexpected storms with confidence.

Our Services

Comprehensive Financial Planning

Our unique approach to financial planning takes your entire financial big picture into consideration. We think of each client’s situation as a puzzle. You may have only a few pieces or many pieces that all need to come together seamlessly to form your complete picture. Some of the pieces that we analyze to build your comprehensive plan include investments, income, taxation, risk, Social Security benefit timing, spousal income replacement, long-term care planning and more.

Pre-Retirement Planning

We can help you have the retirement of your dreams, but we need to know what those dreams look like. We work with every client to help them build a comprehensive plan for retirement that will meet their income needs and fulfill their retirement dreams. Some of the things that we consider as part of the planning process include investments, income, taxation, risk, Social Security benefit timing, spousal income replacement, long-term care planning and more.

Investment Strategies

Stock picking and day-trading may work for some, but probably not for long. We believe in sound, long-term investment strategies designed to balance risk and performance over time to help you achieve your long-term goals. Our firm is large enough to be able to meet just about every need, but we are still small enough to offer “boutique” high net worth strategies that other large firms just can’t provide. Our unique approach to investing can give you a personalized plan that allows you to do get on with your life and enjoy the things that you love.

Asset Preservation

We help you find the right balance of safety and risk and bring those two competing worlds together for your benefit. Safe instruments such as insurance or annuities can play a vital role in finding that balance and creating income that will last throughout your life. We help demystify these products through easy-to-understand education and explanations.

Long-term Care Planning

When you think of long-term care, nursing homes probably come to mind. However, long-term care has evolved and can mean anything from getting help at home to assisted living. The longer we live, the more likely we are to become frail. We help you develop a plan when you need help. The best time for a plan is now so that you can rest assured that you will be taken care of in the future without being a burden to your family.

Generational Wealth Planning

To many of us, it’s important to leave a legacy behind for our kids and our grandkids. We can help you build a plan to enjoy your retirement while at the same time enhancing the legacy that you will leave for your family. Taxes play a huge role in generational wealth planning, and we can help you leave behind not only a legacy to your family, but the right kind of legacy that will have minimal tax consequences for them.

Strategic Tax Planning

Taxes are one of the most important things to consider in retirement. It’s easy to decide that it’s time to start drawing on your hard-earned nest egg. The hard part is knowing which of your funds is the most tax-efficient place to draw from and when. We can help you keep a balance of income that will minimize taxation and avoid higher tax rates in the future.

Start Investing In Your Future

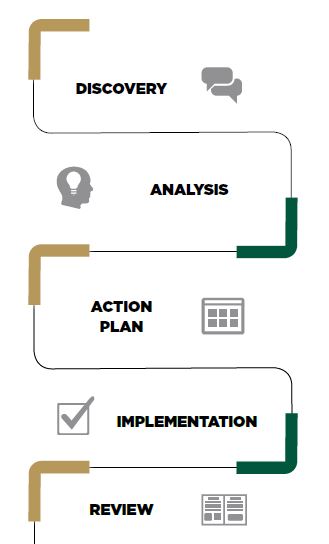

Ready to take control of your financial future? Getting started with our firm is simple and straightforward.