What is Comprehensive Financial Planning?

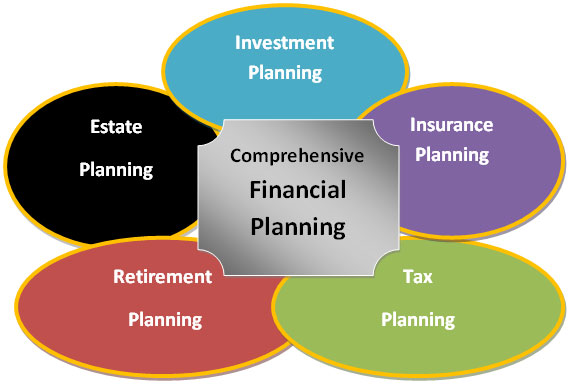

Most of us spend time focusing on the ups and downs of our retirement accounts. However, it’s important to remember that investments are only one piece of a rounded, healthy financial plan. What’s the point in having all that money if you neglect to protect it from excess taxes, inflation and health related catastrophes? Your nest egg could dwindle quickly without comprehensive planning.

When we meet with clients, we follow a careful 5-step planning process. You won’t be pressured into becoming a client on your first appointment. We want to get to know you and your goals or concerns. Likewise, we want you to get to know us. It’s so important to build a relationship of trust and mutual respect to build your plan together. We don’t skip steps nor do we rush you through the planning process. We work at your pace to be sure you understand your plan through every step of the process.

If your adviser isn’t talking to you about maximizing your Social Security retirement benefit, building life-long income, estate planning, preparing for future medical costs, beating inflation, minimizing taxes AND maximizing investments, it’s time to consider a second opinion. As a CFP – Certified Financial Planner™, Kelley Pyles is professionally trained in each of these critical retirement planning categories. You worked hard to earn your retirement assets so take the time to plan smart.